EU countries continue delivering oil and gas technologies to Russia in spite of war and sanctions

Limiting Russia’s earnings from gas and oil exports and gradually refusing to buy fossil fuels from the aggressor to full halt has been the central piece of Western sanctions. The chief goal is to curb the Kremlin’s capacity to finance the war in Ukraine and ultimately to force it to seek peace.

Last month, as the European Union enforced its 11th sanctions package, targeting oil exports from Russia, an investigative outlet published a research about European companies involved in the supply of advanced, dual use technologies and equipment for the entire chain of oil and gas production.

Gas affairs

Last September, Russia halted the operations of the "Nord Stream 1" pipeline that delivers natural gas from the Leningrad region to Germany. In early 2022, this pipeline accounted for over half of Russia's gas exports to the EU, and in 2021, it was 40%, according to data from Bruegel. Gas supplies via the "Yamal-Europe" pipeline also stopped, and transit through Ukraine decreased (in 2024, it may cease entirely), says Novaya Gazeta.

In 2023, pipeline gas deliveries from Russia to Europe decreased by 85% compared to the same pre-war period in 2021. As a result, Gazprom was forced to reduce gas production by almost a quarter. Tax revenues and export duties on gas decreased by almost half, amounting to 710 billion rubles in January to May of this year, according to the report.

While inflicting losses in the Russian gas industry and cutting down the Kremlin’s revenues, the EU, paradoxically, not only imposes sanctions but also helps the aggressor develop alternative ways of exporting energy resources.

Firstly, Europe is increasing its purchases of liquefied natural gas (LNG) from Russia. In the first five months of 2023, these purchases increased by almost 30% compared to January to May 2021.

The European Union is investing billions of euros in building new infrastructure for LNG imports to reduce dependency on Russian natural gas. However, they are simply shifting to LNG from Russia, as noted by Lithuanian Deputy Energy Minister Albina Zananavicius in a comment to Reuters.

In addition, the European Union is supplying Russia with technologies for the development of LNG, despite a clear ban envisaged in the fifth package of sanctions in April 2022.

Data extracted from the ImportGenius database show that from 24 February to the end of November 2022, for example, Russia imported equipment worth almost 420 million dollars (28.5 billion rubles) from the EU for the construction of the new "Arctic LNG 2" plant on the Gydan Peninsula near Yamal. Once operational, this plant will become one of the largest in Russia, with 80% of the gas planned to be sold to Asia.

More to read:

Russian government classifies gas and oil production and export statistics

A 60% majority of the "Arctic LNG 2" project (60%) in an investment from Novatek, the largest private gas producing company in Russia.

Among its shareholders are Leonid Mikhelson, a friend of Vladimir Putin, Gennady Timchenko (who is under EU sanctions), the French corporation Total, and Gazprom. In 2022, Total became the leading earner in Russia among foreign companies that has remained in Russia since the war broke out.

Despite the war and sanctions, Novatek managed to receive the main equipment for all three lines of "Arctic LNG 2." According to customs data, the major suppliers were the American company Baker Hughes and its Italian subsidiary Nuovo Pignone.

From March to August, the two Western companies sold equipment worth almost 87 million dollars to Russia, even though Baker Hughes had previously announced that it would cease supplies and services to Russian LNG projects.

Technologies worth tens of millions have been also supplied by German companies Linde and SVT, as well as Italian companies Ansaldo Energia and Officine Ram Power, for the same project.

A portion of 84% of those supplies was supposed to fall under the export control regime, which means that such technologies can only be sold with special licenses. Some of the customs codes under which the equipment was imported to Russia are explicitly listed in the EU Council's regulations on sanctions. Others are included in lists of dual-use goods and advanced technologies, which the EU regularly updates.

Similarly, Gazprom and its subsidiaries continue purchasing equipment from the EU, some being worth 48 million dollars.

Interestingly, some customs filings fail to disclose the countries of origin of the goods.

Another plant which Gazprom is building in the Amur region will allow it to pump gas through the "Power of Siberia" pipeline and sell helium, ethane, propane, and butane to China. The plant is expected to become the second-largest in the world, and its construction is touted as "unprecedented in the history of the Russian gas industry," as the company proudly stated on its website.

Technologies for this plant are delivered European firms: installations for ethane separation from Linde, mixing stations from Mek Piping, and heat exchangers from Siemens. Their total value amounted to least 15 million dollars from late February to November. The plant is planned to be fully operational in 2025.

In another example, Lithuanian logistic companies shipped Italian equipment worth 18 million dollars for REP Holding (part of Gazprom), including components for the gas turbine unit MS5002E, which is used for gas compression in the "Turkish Stream" project.

Oil affairs

The situation in the oil industry is likewise. Sanctions on oil production were imposed as early as 2014 when the European Union and the United States prohibited the supply of equipment for deep-water, arctic, and shale oil projects. In the spring of 2022, following a full-scale invasion of Ukraine, the sanctions were expanded to include equipment for oil production, exploration, and processing.

However, European equipment continued to flow into Russia, including directly from Europe, and European companies played a leading role in this process.

According to ImportGenius statistics, EU exports of oil production equipment to Russia was nearly 73 million dollars from 24 February till late November 2022. This equipment included hydraulic fracturing units designed for arctic conditions, drilling rigs for oil and gas field development and exploration, and various components and consumables.

The largest share - 24 million dollars - was imported directly from Germany by KCA Deutag and its subsidiary Bentec. The latter manufactures drilling rigs in Tyumen, including rigs that operate in arctic conditions.

Another 17.8-million-dollar worth of equipment was imported into Russia by Aris Oilfield Tools Until December 2022, it was controlled by the German company KATT GmbH.

Finally, the third-largest purchaser was Garant Service, a joint venture between Gazprom Neft and Sberbank. Both corporations are under EU sanctions, but that did not stop them from acquiring a drilling rig in Italy for 15 million dollars.

More to read:

China absorbed record volumes of Russian oil in first half of 2023

After the war started, the largest European and American oilfield service companies announced their departure from Russia. For example, Halliburton transferred its assets to the Russian-managed legal entity BurService. Even now it continues to buy equipment from Halliburton and other American and Canadian companies, though doing so indirectly, via Singapore.

Similarly, the American company Schlumberger has remained in Russia and still imports Western technologies via the United Arab Emirates, Singapore, and China.

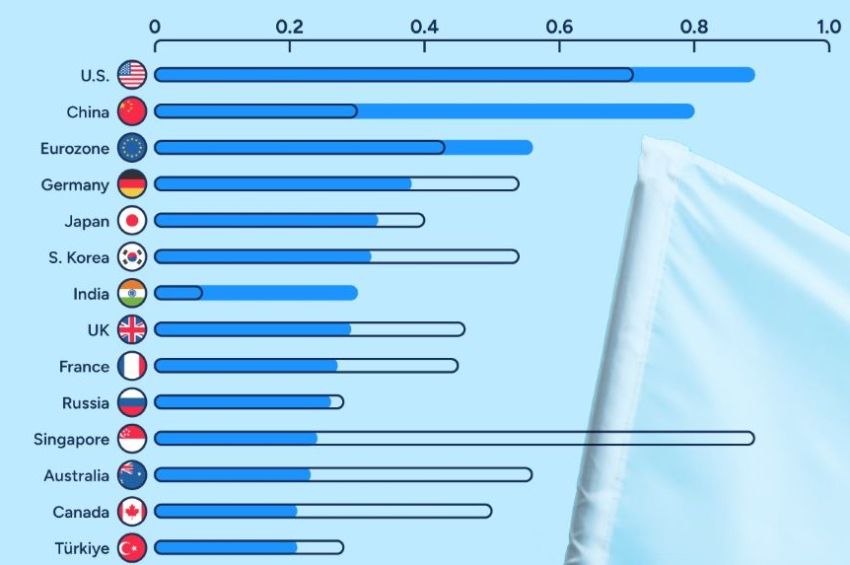

The largest part of goods imported into Russia from the EU for oil production (67%) fall under the category of dual-use products and advanced technologies. In 2022, these imports decreased to approximately the level of 2007 but did not reach zero. Comparatively, they lost 40% in monetary terms, reducing from 30 billion euros in 2021 to 18 billion euros in 2022.

This information is based solely on the official statistics provided by the European Union.

So, how just how much the shipments of advanced equipment and technologies from the European Union to Russia increased in 2022 compared to the previous year:

- Drilling and mining machines: 3.2 times.

- Metal processing machines: 2.4 times.

- Optical instruments for semiconductor device manufacturing: 1.8 times.

- Engines: 1.7 times.

- Pipes for oil or gas pipelines: 1.5 times.

- Tractors and bulldozers: 1.5 times.

- Signaling and rain rockets: 1.2 times.

- Medicines and tomographs: 1.2 times.

- Heat exchangers and compressors: 1.2 times.

- Containers for liquefied gas: 1.1 times.

Source: Eurostat.

In 2022, the shipments of certain goods branded as advanced technologies even increased, including medicines; laboratory and medical equipment; furnaces; heat exchangers; drilling and mining equipment; liquefied gas containers; signaling rockets; smartphones and their components.

The report does not specify whether the European Commission, or the European Parliament, or EU law enforcement agencies are aware of this boost in EU-Russia business in the past 18 months.