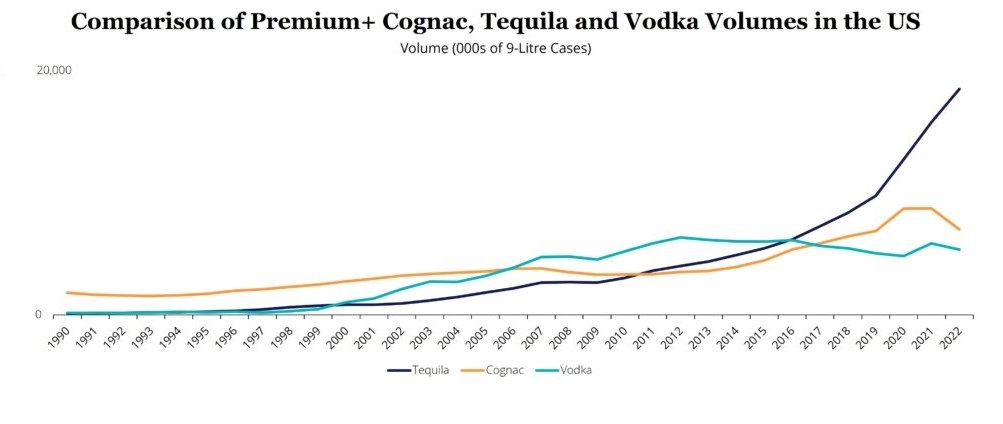

After robust growth during Covid, cognac is losing out to tequila in the U.S.

After experiencing robust and consistent growth for several years, cognac – a French origin spirit – witnessed a substantial surge in global demand during the Covid-19 pandemic. However, the U.S. market, contributing to over 40% of global sales, has recently witnessed a sharp decline, a specialist report says.

From 2014 to 2019, cognac volumes in the U.S. grew at a compound annual growth rate of 12%. Despite further growth during the pandemic, there was a significant decline of -20% in 2022, followed by a continued decrease (-16%) in the first half of 2023 compared to 2022, according to an analysis by the London-based International Wine and Spirits Record.

The decline in cognac volumes in 2022 can be partially attributed to supply chain disruptions related to the Covid-19 pandemic. Brand owners faced challenges due to the high-volume base for comparison in 2021 and a return to more typical consumption patterns. Consequently, the supply chain grappled with elevated levels of cognac inventory.

Credit: IWSR

However, the sharp declines reported in the first half of 2023 seem to have more fundamental causes.

The cognac consumer demographic is feeling the economic impact, leading them to scale back their preference for this high-status, high-priced category in favor of more budget-friendly alternatives, particularly agave-based drinks and cocktails.

Consumer base

IWSR's market and consumer data report indicates that cognac's performance in the U.S. may also be affected by increased competition from agave-based spirits, especially as tequila is pushing for entry in the category of premium beverage to please high-income consumers. There is an overlapping consumer base, with evidence suggesting that cognac and high-end tequila - a Mexican origin spirit - are vying for the attention of the same consumers.

Cognac's consumer base can be segmented into middle-income "core" drinkers and higher-income urban millennials. The core drinkers, who are more financially vulnerable, are likely to reduce their consumption frequency or shift to lower-priced categories due to declining disposable incomes. Moreover, cognac drinkers exhibit a diverse drinks repertoire, with a notable proportion consuming premium tequila and vodka, which are cheaper, making them more inclined to explore alternative spirits in response to economic challenges.

Marketing challenges

Despite these challenges, the decline in cognac consumption is viewed as cyclical rather than structural. Historical trend analysis indicates a correlation between disposable income and cognac volume consumption, suggesting that the category tends to perform well in prosperous times and faces challenges during economic downturns.

To address the current decline, cognac brand owners are advised to broaden the appeal of cognac in the U.S., targeting a wider consumer base. Additionally, diversifying use cases to counteract tequila's advantage in popular cocktails and exploring opportunities in different social settings could contribute to revitalizing the category.

Some brands are already adapting by implementing inventive marketing strategies to attract new customers, especially among untapped demographic groups such as Hispanic and female consumers, and by establishing a stronger presence in the cocktail space, IWSR said.