The life, near-death, and resurrection of Toshiba

Toshiba, one of Japan's oldest and biggest firms, held on 22 December 2023 the first meeting of its new board of directors after its biggest restructuring in history.

The new management met just days after the delisting of Toshiba from the Tokyo Stock Exchange following a 74-year history as a publicly-owned electronics manufacturer spanning its businesses from battery to nuclear.

The company has narrowly avoided a catastrophe that was mainly a consequence of inadequate corporate governance at the top.

The company is now controlled by a group of investors led by private equity firm Japan Industrial Partners (JIP), which took over a majority stake in September. The consortium has purchased 78.65% of Toshiba shares for 14 billion dollars and now owns more than two-thirds of the firm.

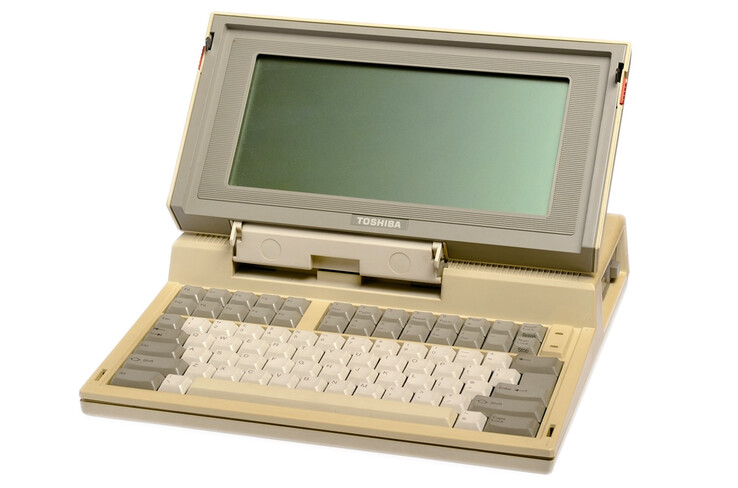

Toshiba joined the stock market in May 1949, marking the economic recovery of Japan after the World War Two and becoming a symbol of its intellectual and industrial potential. It was Toshiba that launched the world's first mass-market laptop computer, in 1985.

So why did one of Japan's renowned industrial giants experience such a dramatic downfall?

Misleading investors

The saga began in 2015 when revelations of accounting malpractices spanning multiple divisions, implicating high-ranking executives, came to light. Over a seven-year period, Toshiba had overstated its profits by 1.59 billion dollars, being slapped with a 47-million-dollar fine for submission of false statements.

In late 2016, Toshiba announced it would shoulder several billion dollars in costs related to the construction of a nuclear power plant acquired by its U.S.

unit, Westinghouse Electric, a year earlier. Within three months, Westinghouse filed for bankruptcy, leaving Toshiba grappling with the collapse of its nuclear business and liabilities exceeding 6 billion dollar.

The world's first PC-based laptop, from Toshiba. Credit: Notebookcheck

To cope with the financial strain, Toshiba divested numerous businesses, including mobile phones, medical systems, and white goods. Additionally, it faced challenges in selling its chip unit, Toshiba Memory, as the deal encountered delays due to disputes with one of its partners.

During an era when companies were heavily investing in the future of technology and innovation, Toshiba found itself compelled to divest a valuable asset to generate much-needed cash. By the end of 2017, Toshiba successfully secured a 5.4 billion cash injection from overseas investors, preventing a forced delisting.

However, this financial maneuver gave activist shareholders increased influence over the company's trajectory, leading to prolonged conflicts that paralyzed the manufacturer of batteries, chips, and nuclear and defense equipment. Amid debates on whether the company should undergo a breakup into smaller entities, Toshiba established a committee to investigate the possibility of going private.

In 2020, further accounting irregularities were uncovered, coupled with allegations concerning corporate governance and the decision-making process for shareholder matters.

More to read:

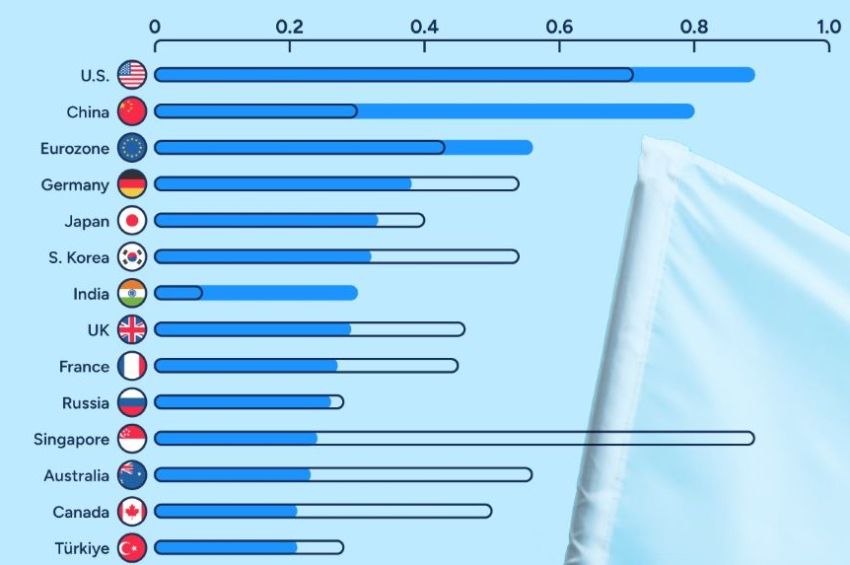

In 2023, Australia was most secure country for investors, Belarus the least

A subsequent investigation in 2021 revealed collusion between Toshiba and Japan's Trade Ministry, which viewed Toshiba as a strategic asset, aimed at suppressing the interests of foreign investors. This development not only impacted Toshiba’s reputation but also cast a shadow over confidence in investing in Japanese stocks among foreign investors, making it a broader concern for Japan's entire stock market.

In June 2022, Toshiba received eight buyout proposals, marking a significant development in its ongoing strategic considerations.

Will Toshiba survive?

Under the deal, Toshiba shares would be taken off the stock market by the end of this year, which means that in July 2025 the company will mark its 150-year anniversary as a fully private entity.

It's not clear yet how the new owners plan to rescue the mammoth corporation, but it looks like Toshiba will survive the current crisis. And there are several reasons to think this way.

One is that JIP has a positive track record in helping businesses reinvent themselves. In 2014, it acquired Sony’s Vaio laptop business, which ultimately reported record sales in 2023. Another example is the purchase of Olympus' camera unit.

More to read:

Why Colombian rum maker hired AI robot as company CEO

Then, former management officials and new directors hinted that Toshiba would put a greater focus on high-margin digital services, where the company has earned a big deal of experience. So there's hope for a new beginning.

Last but not least, it’s the government that is vitally interested to keep it afloat and thriving - Toshiba employs around 106,000 people and some of its operations are critical to Japan’s national security. Therefor it would bail out if necessary. Toshiba’s failure will be a disaster for Japan.