Valued at $150 billion, yet OpenAI is a loss-generating enterprise

Sam Altman, CEO of OpenAI, has been busy these days transitioning this entity – now a non-profit research organization – into a commercial project. His plan has attracted a new financial injection of $5 billion, raising OpenAI’s valuation at $150 billion dollars.

However, as the AI revolution is slowing down on profitableness, the whole thing feels like hype with little substance. As huge money keeps coming in and the entity is unable to cover its operations, one question begs to be asked: “Is OpenAI a Ponzi scheme in plain sight?”

Let’s start by defining a Ponzi scheme. According to dictionary, it’s a fraudulent scheme where returns to early investors are paid from the investments of new ones. This definition doesn’t fit OpenAI at first glance because it’s a fully operational company with products used by millions.

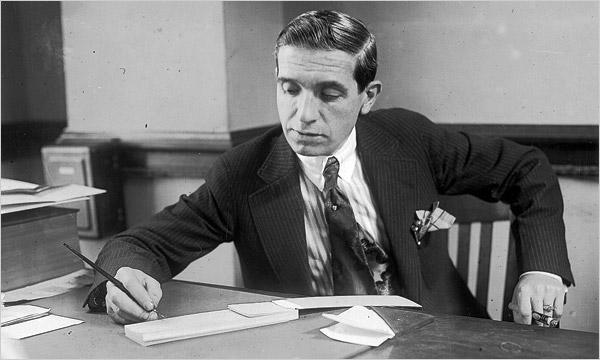

Charles Ponzi, the namesake of the scheme, in 1920. Credit: Wikipedia