Federal Reserve launches instant payments service

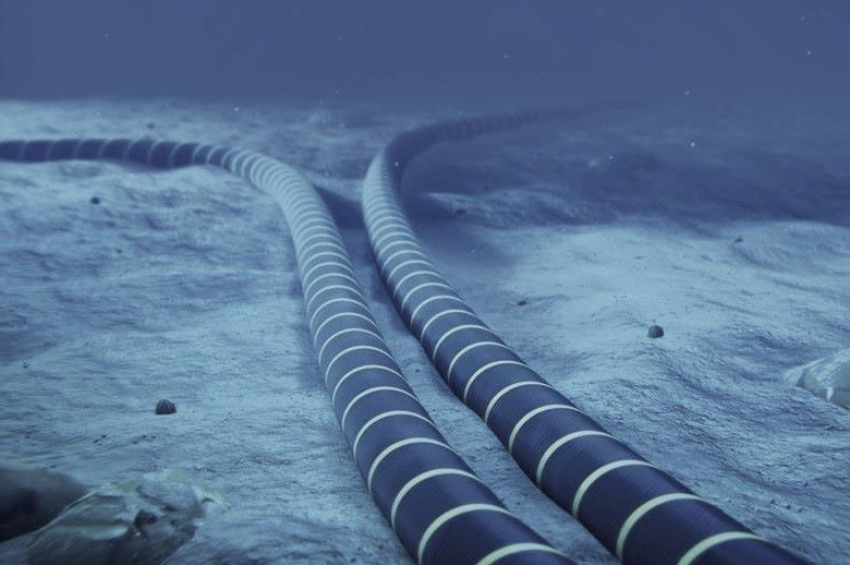

The Federal Reserve has modernized the country’s payment system by launching the app FedNow, which will allow Americans to send and receive funds in seconds, 24 hours a day, seven days a week.

The US central bank announced in a statement on Thursday that the service - "FedNow" - has been in the works since 2019 and, once enacted, will eliminate the several-day lag it commonly takes cash transfers to settle. This will bring the United States in line with countries including the United Kingdom, India, Brazil, as well as the European Union, where similar services have existed for years.

FedNow launched with 41 banks and 15 service providers certified to use it, including community banks and large lenders like JPMorgan Chase, Bank of New York Mellon, and US Bancorp, and more banks and credit unions are expected to join this year.

At least 35 entities are using FedNow at present, among them the Treasury Department's Bureau of Fiscal Service.

The inter-bank service will compete with private sector real-time payments systems and was initially opposed by big banks who said it was redundant. But many have since agreed to participate on the basis FedNow will allow them to expand the services they can offer clients.

Unlike peer-to-peer payments services like Venmo or PayPal, which act as intermediaries between banks, payments made via FedNow will settle directly in central bank accounts.

The Federal Reserve also operates a real-time payments system called FedWire, which is designed for large-scale, mostly corporate payments and is only operational during business hours. While the new FedNow system is for everyone, it's likely to benefit consumers and small businesses the most, according to Reuters.

As a matter of fact, it was smaller banks, which often connect to FedWire via larger lenders, that encouraged the authorities to develop FedNow, arguing that it would allow them access to real-time payments without having to pay larger competitors for the service.

FedNow will not charge consumers, although it's unclear whether or how participating banks will pass on any costs associated with the service. It is expected, however, to save consumers billions of dollars annually.

At the beginning, FedNow will have a maximum payment limit of 500,000 dollars, but banks can choose to lower that cap at their discretion.