Startup builds platform for financial AI applications

A startup based in New York, Cognaize Holdings Inc., has recently raised 18 million dollars from a bunch of investors including Agronautic Ventures and Metaplanet for research and development of an innovative large language model in the finance sector.

Cognaize will use the funds to increase staff size, launch new research and development efforts, and create additional products.

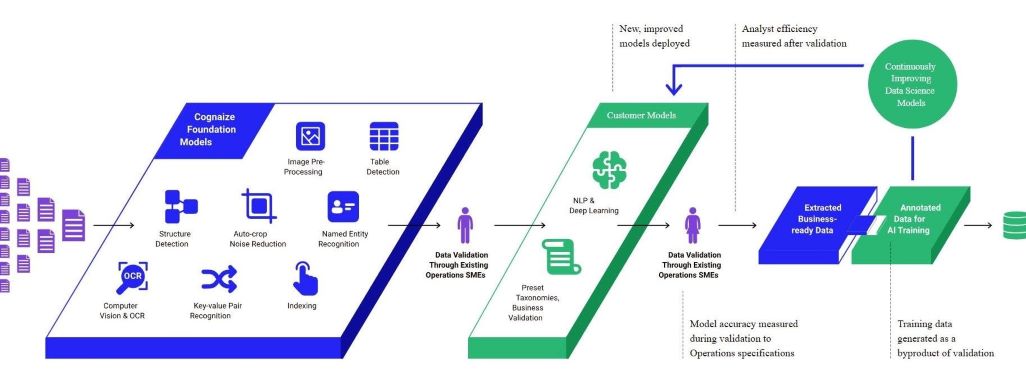

Cognaize has built a platform that would transform the banking industry by harnessing the untapped potential of unstructured data for use in financial artificial intelligence (AI) applications. The platform taps deep learning trained specifically on financial models and a very wide variety of documents — 1.3 million in all — that might have many different “cells” of information on them requiring a more expert eye to read.

Cognaize's methodology of AI training for the finance sector.

The present-day finance sector is typically focused on structured data, while the Cognaize founder believes that a vast amount of valuable information remains buried in unstructured formats, waiting to be mined for useful insights, the company said on its blog.

Unstructured data encompasses a wide range of documents, such as loan applications, SEC filings, environmental reports, trustee documents, and more.

These documents may contain numerous "cells" of information that require a keen eye and human expertise to interpret accurately.

To tackle this challenge, Cognaize employs a hybrid approach that combines the power of deep learning technology with human input. The company's platform is based on deep learning tools trained exclusively on financial models and a vast corpus of over 1.3 million documents. This blend of AI and human expertise allows the platform to extract insights with remarkable precision and speed.

More to read:

Why does Google build an AI news writer?

Cognaize acknowledges that while AI has the potential to advance in unimaginable ways, it can never fully replace human expertise. Therefore, the platform incorporates "humans in the loop," enabling financial analysts and other experts to fine-tune the AI's readings and draw well-informed conclusions based on the results.

Cognaize's unique platform has garnered the attention of major players in the financial industry. Two of the three largest credit rating agencies, as well as leading insurance providers and banks, have already signed on as clients.

In addition to its New York headquarters, Cognaize Holdings also operates two more offices – one in Frankfurt, Germany, and another in Yerevan, Armenia.

It was founded in 2018 by Vahe Andonians, who serves as the company’s Chief Technology Officer and Chief Product Officer. A serial entrepreneur of Armenian descent in the fintech industry, he most recently led SCDM, an AI-based fixed income analytics firm, which in 2017 was acquired by Deloitte.

Vahe is also a senior lecturer at the Frankfurt School of Finance & Management and a partner alongside Moody's Analytics at Traidum, building a blockchain-based negotiation platform for trading structured credit products.