Visa expands its cross-border transactions to Solana, widens USDC payment capability

The global payments firm Visa has expanded its stablecoin settlement capability to include USDC tokens issued on the Solana blockchain.

Solana said Visa has rolled out support for USD Coin payments settled on the Solana blockchain as its stablecoin offering begins to expand.

Visa unveiled its ongoing and completed pilot programs with issuers and acquirers, facilitating the seamless transfer of millions of USDC (USD Coin) between partners on both the Ethereum and Solana blockchains for fiat-based payment settlements. This adoption extends from initial pilot initiatives involving Crypto.com to broader integrations with renowned merchant payment processors like Worldpay and Nuvei.

The inclusion of USDC issued on Ethereum and Solana into Visa's ecosystem empowers the former to leverage Visa's treasury and settlement infrastructure, effectively bridging the gap between traditional finance and the decentralized Web3 environment. Cuy Sheffield, Visa's Head of Crypto, emphasized that harnessing stablecoins like USDC and the capabilities of blockchains such as Ethereum and Solana significantly enhances the speed of cross-border settlements.

More to read:

Binance becomes first fully licensed crypto exchange in El Salvador

Visa's journey with USDC experimentation commenced in 2021 in collaboration with Crypto.com, focusing on testing stablecoin settlements from the issuance perspective.

The resultant pilot program utilized Ethereum-based USDC to receive payments from Crypto.com for cross-border transactions within its Australian card program.

Previously, settling cross-border purchases made with Crypto.com Visa cards involved time-consuming currency conversion processes spanning multiple days and accumulating substantial wire transfer fees. Consequently, the crypto exchange now relies on USDC for fulfilling its settlement obligations related to its Australian Visa card.

Additionally, Crypto.com leverages a Visa treasury-managed account in conjunction with Circle, the issuer of USD Coin, to facilitate the efficient cross-border transfer of USDC on the Ethereum blockchain. This approach reportedly streamlines the complexity and duration of international wire transfers.

The integration of USDC also grants Visa the ability to transfer funds to USDC acquirers, including Worldpay and Nuvei, thereby reducing settlement times for merchants availing their services. Subsequently, these payment processors can direct USDC payments to the merchants they cater to, establishing a vital link between Visa's traditional fiat ecosystem and the world of stablecoins and cryptocurrencies that they serve.

More to read:

Deutsche Bank applies for license to become crypto custodian

Thus, Visa's USDC settlement capabilities provide an array of choices for merchants in terms of receiving funds and enable more effective management of its treasury operations.

Furthermore, Visa is actively exploring a solution for executing off-chain gas fee settlements on the Ethereum network by employing a Paymaster smart contract. These specialized smart contracts possess the capability to facilitate user payments and execute various transaction-related functions.

Solana losing users

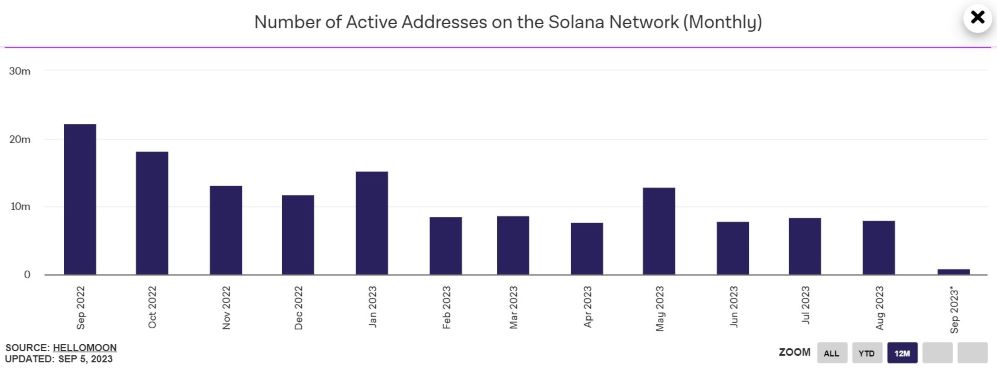

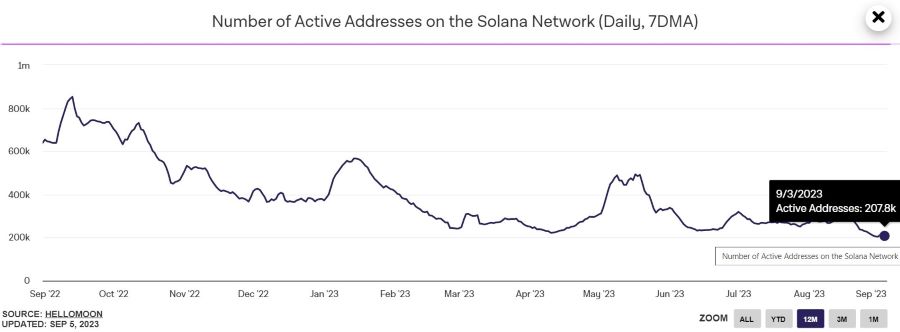

Meanwhile, Solana’s daily active addresses declined to around 204,000 as of 31 August, the lowest level over the past two years, according to The Block’s dashboard.

The Layer 1 blockchain Solana is continuing to lose momentum, with the number of daily active addresses hitting the lowest point since The Block started tracking the data in late 2020.

The number of active users recovered somewhat to 207,800 on 3 September, but the value of transactions yet was the lowest during the past 12 months – 64.63 million US dollars.