The highest rate of millionaires was in Iceland in 2022

For the first time since 2008, global household wealth in US dollar terms decreased on aggregate as well as on a per adult basis, both in nominal and real terms. Wealth per adult also recorded the second-largest reduction since 2000, according to the 2023 Global Wealth Report released by UBS Group AG, a multinational investment bank and financial services company founded and based in Switzerland.

Mean wealth

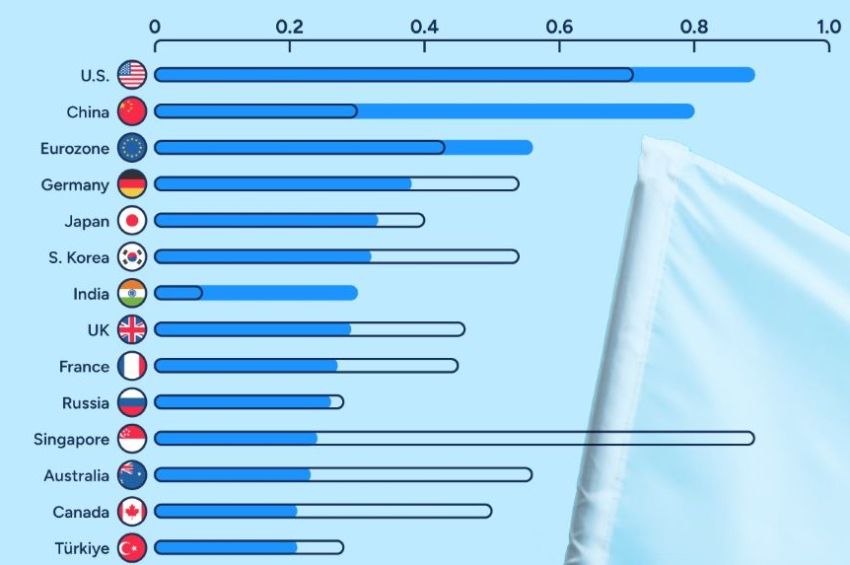

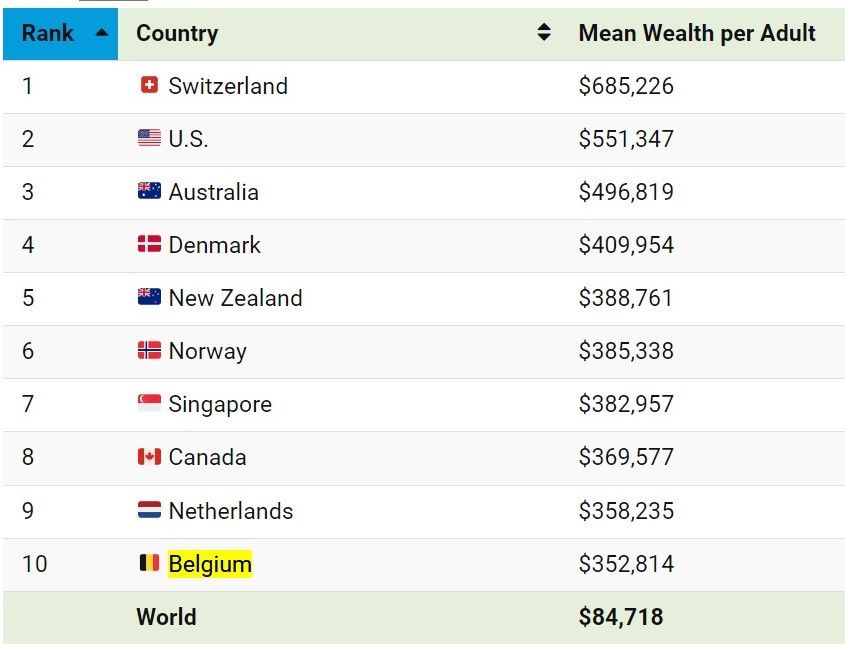

In 2022, global mean wealth per adult stood at 84,718 US dollars, with Switzerland holding the best performance with 685,226 dollars per person. Over 15% of the Swiss population are millionaires, the third-highest rate in the world, says the report that cites data from Statista.

Credit: Visualcapitalist.com

Like Switzerland, five of the top 10 countries by average wealth are in Western Europe, including Denmark, Norway, the Netherlands, and Belgium. The United States ranks the second by average wealth per person (551,347 dollars), followed by Australia (496,819 dollars). New Zealand is on the 5th spot, Singapore on the 7th place, and Canada is 9th. Germany ranked the 15th.

The US is home to 38% of global millionaires, outpacing the second-highest country - China, by more than three times. With a significant wealth gap, income inequality in the U.S. is among the highest across developed nations. Singapore has the highest average wealth per adult across Asia and its income inequality falls at a similar level to the U.S.

Median wealth

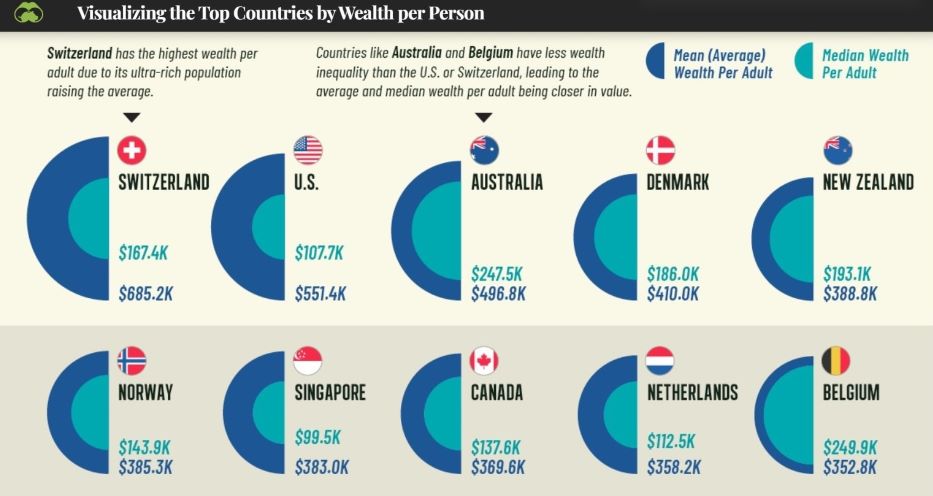

However, wealth shifts when looking from a median wealth per adult basis. While the mean statistics shows the arithmetic average of a set of numbers, median numeric value separating the higher half of a sample, resulting in a more realistic picture.

More to read:

A market analyst predicts the collapse of the central banking system

Belgium ranks the highest with 249,937 dollars (compared with 352,814 in terms of average wealth per adult), beating past Australia for the first time, and the explanation lies in the high home ownership levels and elevated home prices, which gave the country advantage over other European countries.

The top ten list of best countries with the lowest inequality continued to be dominated by European markets and Switzerland there is only on the 5th place.

Credit: Visualcapitalist.com

The U.S. ranked the 12th with 107,739 dollars, China the 26th with 27,273 dollars, Germany the 24th, and the global median wealth per person stood at 8,654 dollars.

Across the dataset, the U.S. saw the steepest gap. Median wealth per adult was $107,739—80.5% lower than average wealth levels. This means that wealth ownership skews disproportionately to the country’s richest. Following the U.S. were South Africa, Russia, and India for illustrating the widest disparities between average and median wealth.

Number of millionaires

Out of the 5.4 billion adult population, there are 59.4 millionaires worldwide, or 1.1%. Measured by continent, 42% are in North America, 27% in Europe, 16% in Asia-Pacific (excluding China and India), 10% in China, and 5% in the rest of the world.

Iceland was the country with the highest rate of millionaires worldwide in 2022, with more than 20% of the adult population (372,900 people) owning assets worth more than one million U.S. dollars. Luxembourg followed behind with 16% of the population (647,600) being millionaires, and Switzerland in third with 15% out of 8,815,400 people.

Credit: Visualcapitalist.com

Projections

UBS economists found that financial assets contributed most to wealth declines in 2022 while nonfinancial assets (mostly real estate) stayed resilient, despite rapidly rising interest rates. But the relative contributions of financial and non-financial assets may reverse in 2023, if house prices decline in response to higher interest rates.

Regionally, the loss of global wealth was heavily concentrated in wealthier regions such as North America and Europe, which together shed 10.9 trillion dollars. Asia Pacific recorded losses of 2.1 trillion, while Latin America is the outlier with a total wealth increase of 2.4 trillion, helped by an average 6% currency appreciation against the US dollar.

More to read:

Central banks buy a record amount of gold in Q1/2023 amid fears of recession

Heading the list of losses in country terms in 2022 is the United States, followed by Japan, China, Canada and Australia. The largest wealth increases at the other end were recorded for Russia, Mexico, India and Brazil.

According to UBS projections, global wealth will rise by 38% over the next five years, reaching 629 trillion dollars by 2027. Growth by middle-income markets will be the primary driver of global trends.

It estimates wealth per adult to reach 110,270 dollars in 2027 and the number of millionaires to reach 86 million while the number of ultra-high-net-worth individuals is likely to rise to 372,000 individuals.

Over the years, the report has explored a wide range of macro and micro themes around the development of wealth. Now in its fourteenth edition, the Global Wealth Report covers estimates of the wealth holdings of 5.4 billion adults around the world and across the wealth spectrum. The 2023 edition is a collaboration between UBS and Credit Suisse, which separately published the global wealth trends.

UBS Group is a public company incorporated in Switzerland; its main offices are in Zurich. UBS is listed on the Swiss Stock Exchange and the New York Stock Exchange.

Browse for UBS Wealth Report datasets here.

***

Feel free to support our small office: IBAN - RO50BTRLEURCRT0490900501, Swift - BTRLRO22, Beneficiary - Rudeana SRL.

Not feeling like donating? Then click on banners on our website to generate ad revenue. Any help is welcome.