Kazakhstan bans Coinbase, but unblocks Interactive Brokers and NYMEX

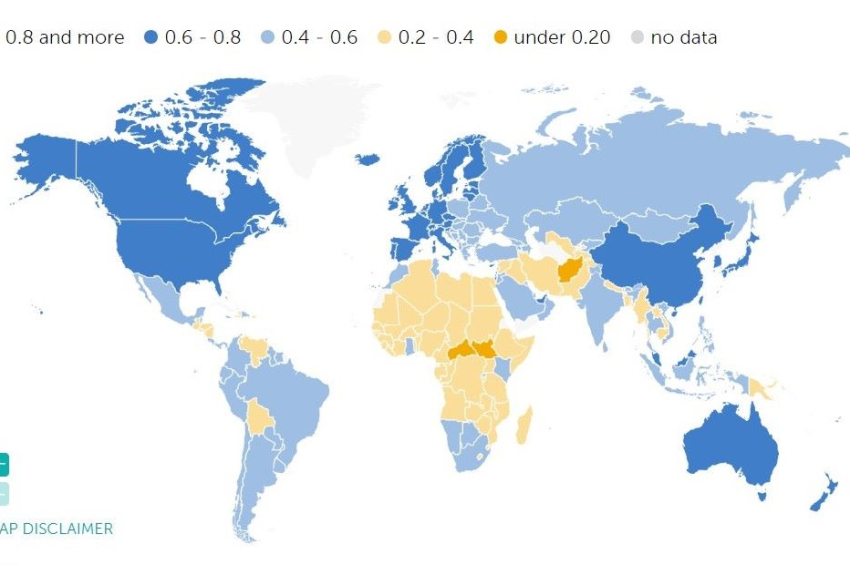

Kazakhstan, a former Soviet republic in Central Asia, has banned the crypto exchange Coinbase, with the Ministry of Culture and Information citing violations of local regulations governing digital assets, an official term for money laundering.

Local media said the decision to restrict the access to Coinbase was made in response to a request from the Ministry of Digital Development, which said the trading of cryptocurrencies on the platform violated Kazakhstan's Law on Digital Assets. This particular law prohibits the issuance and circulation of uninsured digital assets, as well as the operation of exchanges trading in such assets.

While licenses for crypto exchanges have been granted to platforms like Binance and Upbit within the special economic zone of the Astana International Financial Centre (AIFC), Coinbase does not have permission to offer its services in Kazakhstan outside of this jurisdiction.

Interestingly, the government has quietly unblocked access to global trading platforms Interactive Brokers and the New York Mercantile Exchange (NYMEX), which were initially blocked earlier this year for similar allegations.

More to read:

Kazakhstan welcomes Binance’s local digital asset platform with fanfare

Whether Interactive Brokers and NYMEX have complied with the rules or paid off regulators – a frequent practice in Kazakhstan – remains unclear.

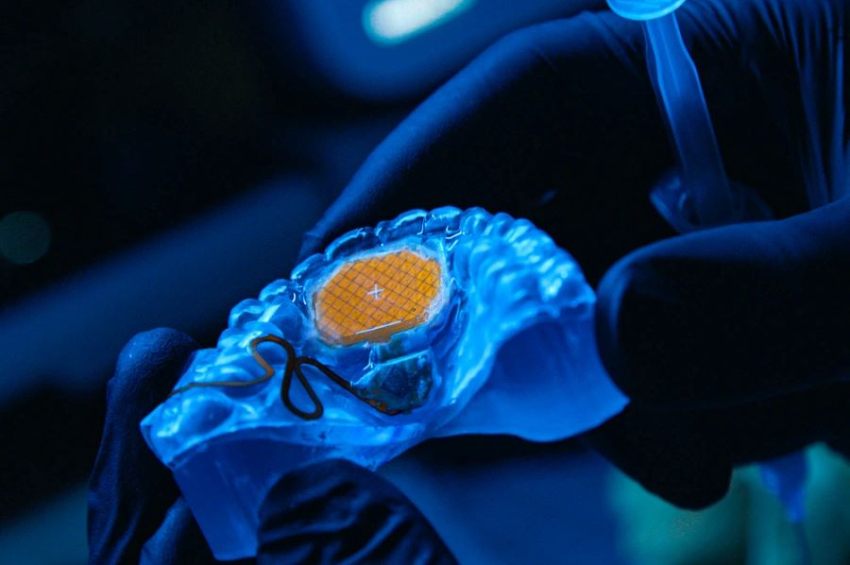

Under AIFC rules, foreign companies can obtain licenses to offer financial and technology services within the special economic zone by submitting an application to the AFSA. Even those unable to meet immediate requirements can gain admission by joining a special "FinTech Lab" regulatory sandbox.

Kazakhstan is among the nations enforcing strict rules on foreign trading platforms, although it does not prohibit crypto operations as such. After China’s crackdown on the domestic crypto industry, the former Soviet republic in Central Asia experienced a Bitcoin mining boom in early 2021. Since then, its government tightened the financial and regulatory control on the industry as a whole.