Russia passes crypto mining and crypto payments laws to counter Western sanctions

Russian lawmakers passed new legislation in late July to allow businesses to mine crypto currencies and use them in international trade payments, as part of efforts to circumvent Western sanctions as a result of Russia's invasion of Ukraine.

The head of the State Duma, lower house of parliament, Anatoly Aksakov, described the effort as “a historic decision for the Russian financial sector.”

However, once approved in the second reading in the Federation Council, the upper house, and signed by president Vladimir Putin, the law would not lift the existing ban on crypto payments inside the country.

More to read:

Binance exits Russian market, sells business to obscure firm

Under the new crypto legislation, the central bank will create an "experimental" infrastructure for cryptocurrency payments, with details about it to be released later. Crypto mining will be authorized in special zones and will require special permits from the regulator.

Private citizens will be allowed to mine small amounts within certain energy consumption limits.

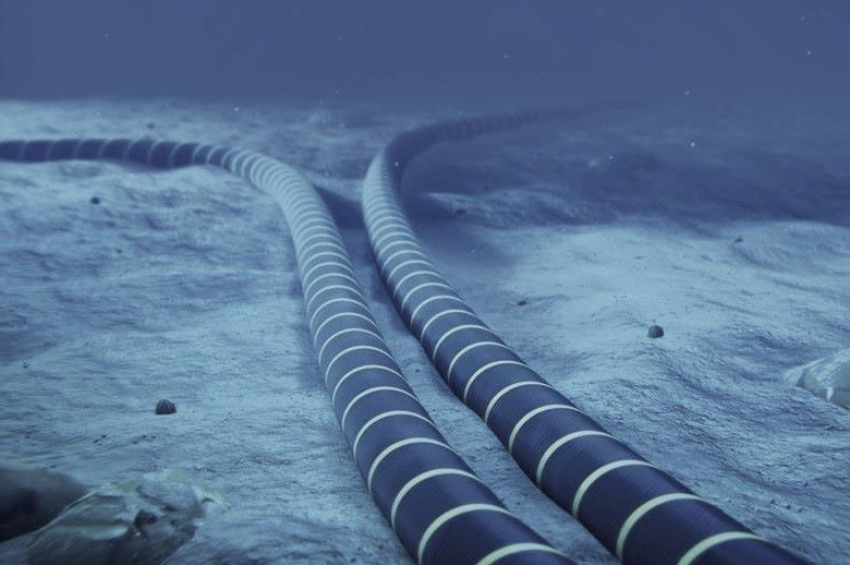

Russia struggles with significant delays in international payments with major trading partners such as China, India and the Middle-Easterners after banks in those countries have become more cautious under pressure from Western regulators.

The central bank said recently that delays in payments have become a major challenge for the Russian economy, leading to an 8% decline in Russian imports in the second quarter of 2024.

More to read:

Russian court seizes €700 million in assets from UniCredit, Deutsche Bank, and Commerzbank

Despite Russia's efforts to switch to the currencies of its trade partners and develop an alternative payment system within the BRICS group of emerging economies, many payments are still conducted in dollars and euros and go through the international SWIFT system.

This exposes banks in countries trading with Russia to the risk of secondary sanctions, forcing them to tighten their compliance procedures.

The new legislation is backed by Russian central bank Governor Elvira Nabiullina, who expects the first transactions in cryptocurrencies will take place before the end of this year. Before the war in Ukraine, she was a staunch opponent of crypto.

"The risks of secondary sanctions have grown. They make payments for imports difficult, and that concerns a wide range of goods," Nabiullina said, stressing that payment delays have led to longer supply chains and rising costs.

The government targets 1 September as the date of enforcement of the new crypto legislation.

***

NewsCafe is an independent outlet that cares about big issues. Our sources of income amount to ads and donations from readers. You can support us via PayPal: office[at]rudeana.com or paypal.me/newscafeeu. We promise to reward this gesture with more captivating and important topics.