Central banks buy a record amount of gold in Q1/2023 amid fears of recession

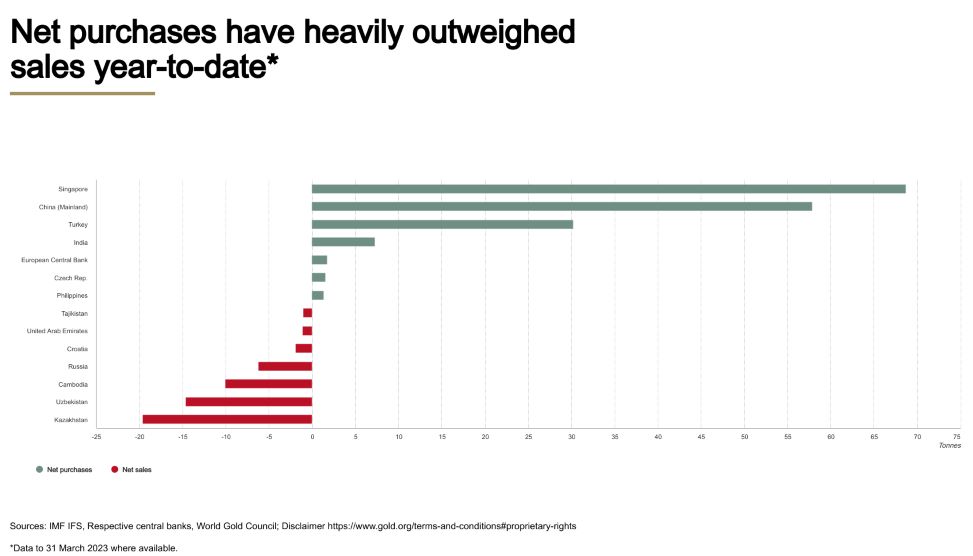

In January-March 2023, central banks around the world purchased 228.4 tons of gold to replenish their reserves, compared to 82.7 tons during the same period of last year (+176%), according to the World Gold Council (WGC), a London-based nonprofit association of leading gold producers.

The volume of purchases is 34% higher than the previous record for the first quarter, set in 2013, and a record high for the first quarter since the collection of such statistics began in 2000.

The decision to increase the holdings in this precious metal is driven by a looming threat of recession in the developed countries and high risks and volatility in their markets, WGC said in its Q1/2023 Gold Demands Trends report.

The report shows that the demand for exchange-traded gold fell 13% in the first quarter compared to the same period of last year. However, overall demand rose 1%, due to the recovering demand on the secondary market.

Singapore's regulator, the Monetary Authority of Singapore (MAS), was the largest buyer of the precious metal in the past quarter, WGC noted. MAS replenished its gold reserves by almost 69 tons, which is 45% more than at the end of 2022.

The People's Bank of China bought almost 58 tons and now holds 2,068 tons of gold in its reserves, which is 4% of the total gold reserves in the world.

The Central Bank of Turkey increased its reserves by more than 30 tons.

The Central Bank of India added over 7 tons of gold to its reserves, to a total of 795 tons.

These four banks account for a clear majority of purchases – 164 tons. Notable purchases were also noted from the Czech Republic (two tons) and the Philippines (one ton).

On the other hand, there are banks which sold gold from their reserves: Kazakhstan (-19.6 tons), Uzbekistan (-14.6 tons), Cambodia (-10), Russia (-6.2), Croatia (-1.9). The United Arab Emirates and Tajikistan sold one plus ton each.

The demand for gold in the second quarter of this year will remain strong and private investments in this precious metal will gain momentum, WGC emphasized.

More to read:

A market analyst predicts the collapse of the central banking system

In 2022, central banks accounted for nearly a quarter of global gold demand. Last year, central banks around the world replenished their own gold reserves by 1,136 tons, which is equivalent to about 70 billion dollars.

Last April, a gold-trading billionaire in Switzerland predicted that the central bank system would collapse in the next few years. Egon von Greyerz, founder and managing partner of Matterhorn Asset Management, said in a commentary that the markets experienced a sharp absence of buyers and the smartest thing to do would be investing in tangible assets, including gold and silver.

Von Greyerz’s pessimism is shared by economist Nouriel Roubini, a professor emeritus at New York University’s Stern School of Business. He told the MarketWatch that the US bank sector was approaching turbulent times due to unrealized securities losses of 620 billion dollars. The collapse of US banks will trigger a financial crisis globally, he warned.

![[video] Kawasaki unveils Corleo, a hydrogen-powered robotic horse with AI management](/news_img/2025/04/11/news2_mediu.jpg)