E.U. and China explore minimum pricing for Chinese EVs

In a significant development in international trade relations, the European Union and China are engaged in discussions to replace existing tariffs on Chinese electric vehicles (EVs) with minimum pricing agreements. This move aims to address concerns over market fairness and the impact of subsidies on global competition.

The E.U. had previously imposed duties between 17% and 35.3% on Chinese EV imports, citing concerns over substantial subsidies provided by the Chinese government to its domestic manufacturers. These subsidies were believed to give Chinese companies an unfair advantage in the European market, leading to distorted competition.

More to read:

[video] Honda launches $36,000 electric SUV for Chinese market

Recent negotiations indicate a potential shift from punitive tariffs to a system of minimum pricing for Chinese EVs sold in Europe. This approach, known as "price undertakings," would involve Chinese manufacturers agreeing not to sell below a certain price point, thereby leveling the playing field for European producers.

While China had proposed a minimum price of €30,000 for its EVs, E.U. negotiators rejected this offer, stating that it did not adequately address the subsidy concerns or ensure effective enforcement mechanisms.

Discussions are ongoing to find a mutually acceptable price floor that satisfies both parties' economic and regulatory requirements.

These discussions occur against a backdrop of escalating trade tensions between China and the United States, with the latter imposing additional tariffs on Chinese goods and prompting a likewise response. China instead appears to be strengthening economic ties with Europe, seeking alternative markets and partnerships to mitigate the impact of Donald Trump’s trade policies.

More to read:

Xiaomi unveils its own electric vehicle

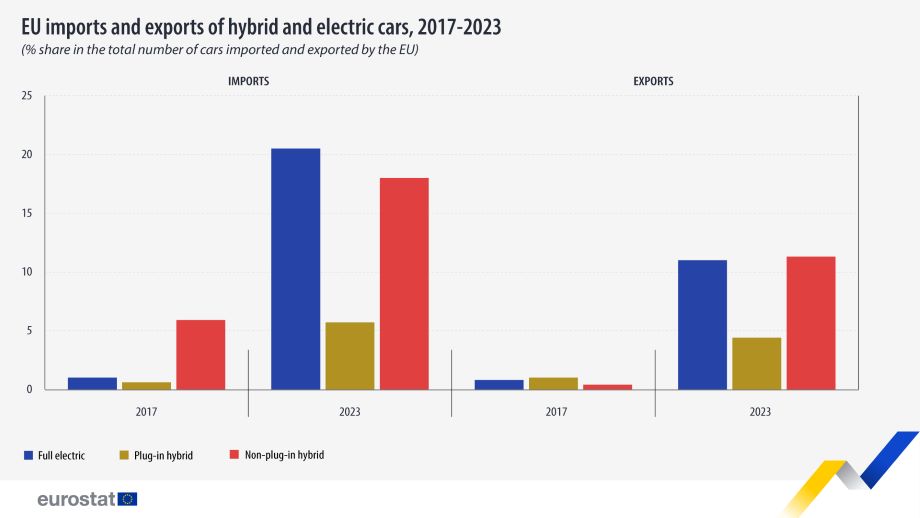

According to Eurostat, the E.U.’s statistical office, between 2017 and 2023, E.U. trade of electric and hybrid cars increased substantially. In 2023, 44% of the total number of cars imported into the EU were electric or hybrid - a significant increase compared with 2017, when the share was 8%. EU exports jumped from 2% of the total number of cars exported in 2017 to 27% of the total in 2023.

The top three countries from which the E.U. imported electric cars in 2023 were China, with €11.0 billion or 49% of the total, followed by South Korea (€4.4 billion or 19%) and the United Kingdom (€2.5 billion or 11%).

The U.S. and Japan accounted for 9% and 7%, respectively. With the trade war ongoing between Europe and America, U.S. EVs manufacturers - chiefly Tesla - will probably see their E.U. market share shrink even further.

***

When you send us a coffee-worth amount, you are funding a small, science-loving media outlet. For 1 euro a month, you actually get a subscription to select topics covered from an unbiased point of view, in an easy to crack way to digest. You are also welcome to send as much as you like, any amount is welcome: PayPal office[at]rudeana.com or https://paypal.me/newscafeeu, or https://buymeacoffee.com/newscafe .

![[video] Kawasaki unveils Corleo, a hydrogen-powered robotic horse with AI management](/news_img/2025/04/11/news2_mediu.jpg)