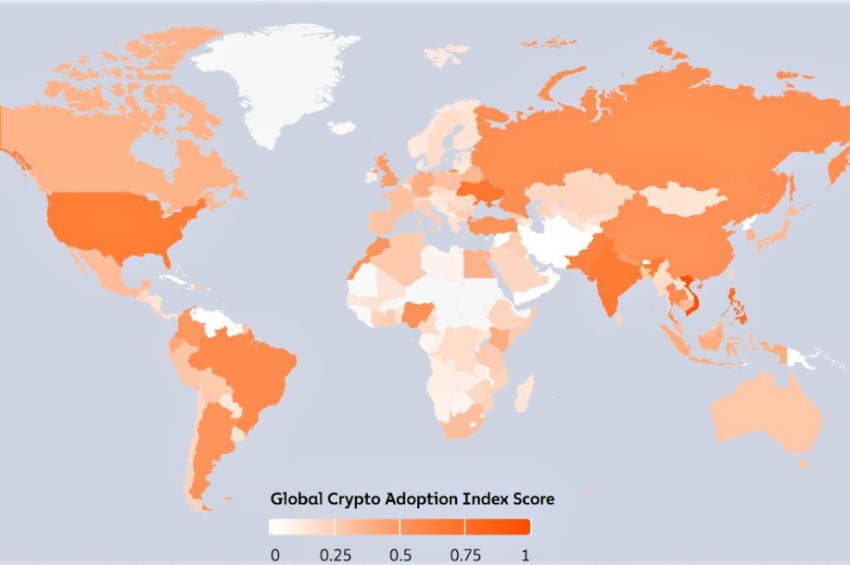

More developing countries embrace cryptocurrencies, but worldwide crypto adoption slows

Global adoption of cryptocurrency reached its all-time high in the second quarter of 2021. Since then, adoption has moved in waves – it fell in the third quarter, which saw crypto prices decline, rebounded in the fourth, when we saw prices rebound to new all-time highs, and has fallen in each of the last two quarters as the sector entered a bear market.

That global adoption remains well above its pre-bull market 2019 levels, according to the 2022 Crypto Geography Report and the 2022 Crypto Adoption Index published by Chainalysis, a US blockchain analysis firm in New York City.

The data suggests that many of those attracted by rising prices in 2020 and 2021 stuck around, and continue to invest significantly in digital assets, which means the cryptocurrency markets have been surprisingly resilient through recent declines.

Big, long-term cryptocurrency holders have continued to hold through the bear market, and so while their portfolios have lost value, those losses aren’t locked in yet because they haven’t sold— the on-chain data suggests those holders are optimistic the market will bounce back, which keeps market fundamentals relatively healthy.

Vietnam on top

The most crypto-friendly country in the world last year was Vietnam, for the second consecutive year. The east-Asian nation shows extremely high purchasing power and population-adjusted adoption across centralized, DeFi, and P2P cryptocurrency tools.

Second in the top-20 is the Philippines and third is Ukraine; the latter relies on crypto donations to defend itself from Russia. The list features only two high income countries – the United States and the United Kingdom.

Emerging markets dominate the top-20 index, given that users in lower middle and upper middle-income countries often rely on cryptocurrency to send remittances, preserve their savings in times of fiat currency volatility, and fulfill other financial needs unique to their economies, the report says.

These countries also tend to lean on Bitcoin and stablecoins more than other countries.

The U.S. climbed to the 5th place from the 8th in 2021 (but 6th in 2020). The U.S. is the highest-ranked developed market country on the Chainalysis index, and one of only two to make the top 20 along with the U.K.

China re-entered the top ten year from the 13th spot in 2021, which is interesting, under the circumstances of the total ban on all cryptocurrency trading. This fact suggests that the ban has either been ineffective or loosely enforced.

The full report is here.