IMF releases blueprint for cross-border central bank digital currencies

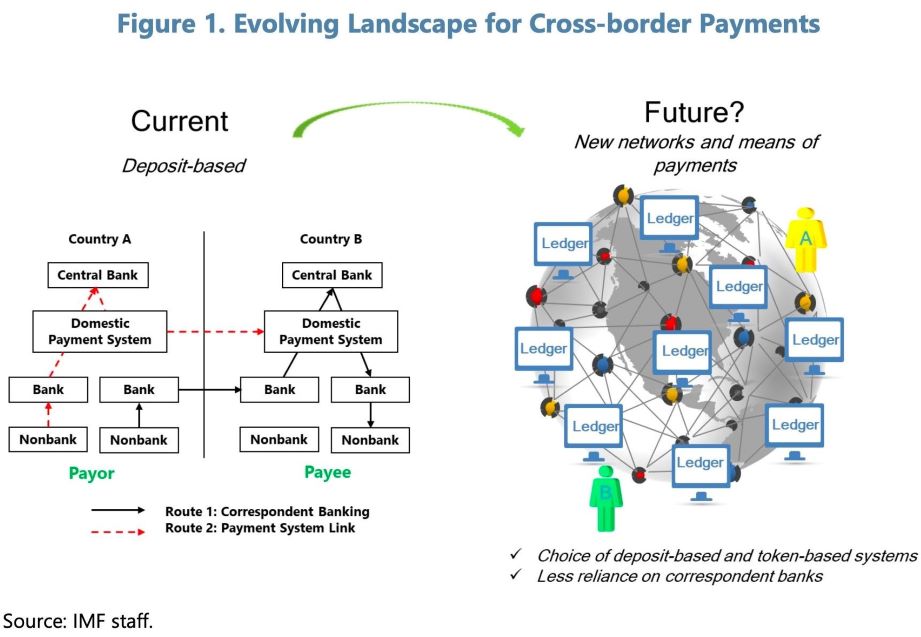

The International Monetary Fund (IMF) favors a new type of platforms for cross-border digital currencies issued by central banks (CBDCs), which - unlike the decentralized financial systems crypto enthusiasts love – these would be controlled by official operators.

The IMF released on 19 June 2023 a blueprint while its managing director Kristalina Georgieva delivered a speech during a visit to Morocco the same day to outline the advantages of CBCD platforms.

More to read:

More developing countries embrace cryptocurrencies, but worldwide crypto adoption slows

According to Tobias Adrian, director of the IMF's monetary and capital markets department, the proposed infrastructure for cross-border transactions would be more secure, easier to handle and less expensive, ensuring due compliance checks and capital controls. The Fund’s official stance on the issue was made public in a April 2023 Fintech Note.

The organization’s vision is based on the same crypto principles but is different from the decentralized financial systems which cryptocurrency exchanges provide today.

The blueprint says the proposed platforms would enhance interoperability, efficiency, and safety in cross-border payments and domestic financial markets, as the existing infrastructure is responsible for high costs, slow processing, and lack of transparency in cross-border payments. The new system would allow payments to be programmed without the payees having to disclose private information to intermediaries. Additionally, contracts could be pledged as collateral to save liquidity, without changing the fungibility of money.

The infrastructure would be managed by an official operator that would control the ledger, which would ensure a unique record of who owns what, preventing double spending.

The IMF’s fintech note rejects the ideas like blockchain-based validation and raises concerns about the “limitations” of blockchain technology, including validator costs, security, efficiency, and privacy. It also mentions that energy consumption is high for Bitcoin-style proof-of-work while and Ethereum's proof-of-stake is expensive and untested.

Governments would retain the authority to limit their citizens' foreign currency transactions and implement anti-money laundering checks.

Although proponents of cryptocurrencies often highlight the ease of cross-border payments, there is competition against free-floating blockchain solutions for this purpose. Standard-setting organizations, including the Bank for International Settlements and private players like SWIFT, are exploring options involving state-backed CBDCs.

More to read:

EU publishes landmark crypto legislation in Official Journal

The Committee on Payments and Market Infrastructures, linked to the Bank for International Settlements, is studying the impact of stablecoins (tokens tied to fiat currency value). In addition, a report from the European Central Bank last year cast doubt on the ability of cryptocurrencies to reduce international payment costs.

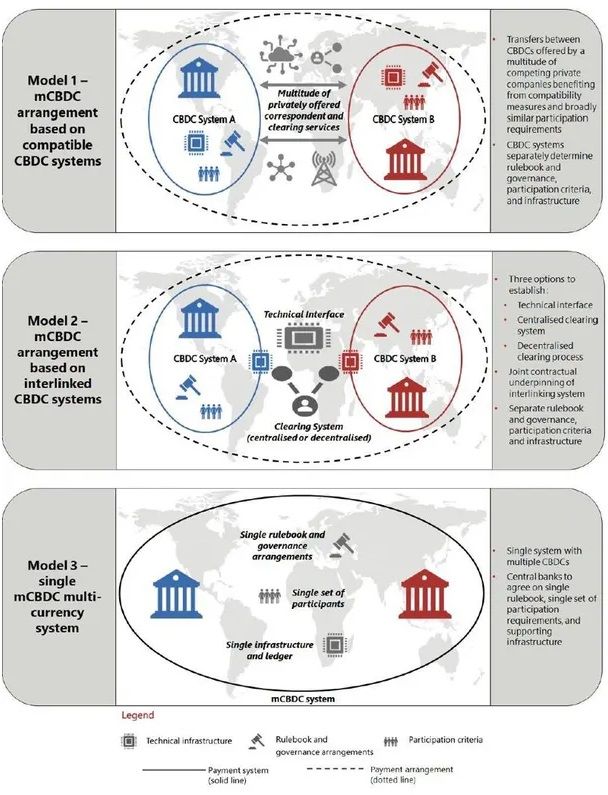

The Fund is working on establishing a global infrastructure that enables different CBDCs to work together.

Throughout the world, governments are introducing tough regulations for cryptocurrency transactions, prompting crypto exchange to withdraw from key markets or engage in legal battles with the financial authorities.