Report: Financial crime proceeds amounted to a staggering 3 trillion dollars in 2023

In 2023, a multitude of transnational illegal activities, ranging from romance scams to human trafficking, amassed over 3.1 trillion US dollars, causing severe repercussions on victims' well-being and, in some instances, their lives.

The 2024 Global Financial Crime Report by Nasdaq, published in January, reveals a profound human toll of the financial crime epidemic beyond monetary consequences, leaving deep scars on communities worldwide.

The illicit cash flows, contributing to the multi-trillion pool, originate from various crimes, including an estimated 782.9 billion dollars from transnational drug trafficking, 346.7 billion from human trafficking, and 485.6 billion from diverse forms of fraud, including 43.6 billion from consumer scams.

Terrorism financing accounted for another 11.5 billion, the report says.

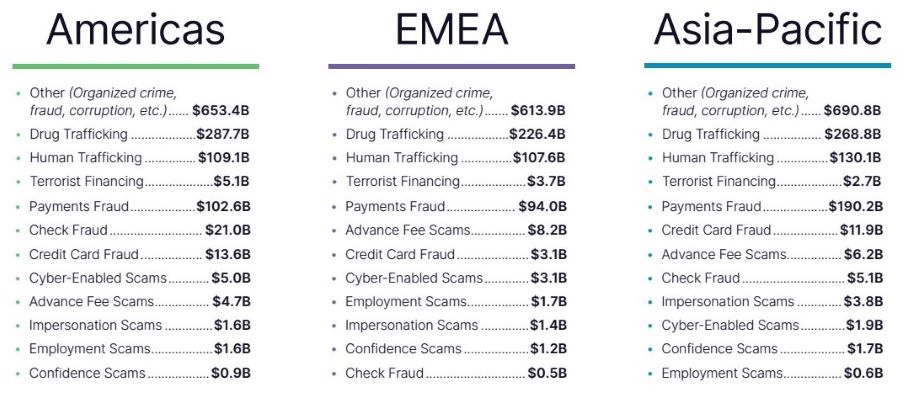

Analyzed regionally, as much as 951.6 billion dollars in illegal proceeds originated in the EMEA, which stands for Europe, Middle East, and Africa, accounting Russia too.

The Americas and the Asia-Pacific generated each 1.1-trillion-dollar worth of illicit revenues.

Organized crime is the major source of illicit money in all the regions, as per Nasdaq data:

The report also contains heartbreaking stories of people who fell victims to various scams and schemes, describing their experiences and suffering.

One of the contributors notes that romance scams are among the fastest growing frauds, advising readers to slow down anytime someone approaches with an emergency and asks for money.

More to read:

[video] How Putin’s elder daughter earns her millions

“Scammers use urgency to get you to act before you think […] it’s a form of emotional exploitation,” says Debby Montgomery Johnson, a fraud awareness advocate and a former intelligence officer.

The report acknowledges the difficulty in accurately quantifying the total cost of financial crime due to underreported instances, as victims often grapple with feelings of shame or helplessness. The disclosed total figure represents an educated estimate based on recorded cases, with Nasdaq hinting that the actual total is considerably higher.

Surprisingly, the Nasdaq report makes no reference to crypto-related crimes specifically and it's unclear whether the funds stolen from exchanges or investors have been accounted for this analysis.

Despite these crimes appearing distant from daily life, the average person bears the cost, either as a direct victim or through increased business fees and government taxes necessary to cover stolen funds.

Nasdaq also surveyed more than 200 industry professionals and interviewed three senior anti-financial crime executives to get a closer touch with the key trends and challenges.

Thus, the analysis identifies the real-time and faster payments as the threats of greatest concern among all financial crimes (52%), followed by money mule activities (47%), and terrorism financing and drug trafficking (33% each).

Interestingly, 53% of respondents said they had adequate resources, including personnel and technology, to combat financial crime.

Both the authors and the respondents recognize the significant role of banks and regulators in preventing and fighting financial crimes, underlining the need for improved regulation, technology upgrading, and better communication between institutions and between institutions and citizens.

Globally, banks reported losses of 442 billion dollars to payment, cheque, and credit card fraud in 2023, or over 14% of total financial crimes, therefore they should be highly motivated to lead the effort.

More to read:

Anonymous hacker exposes almost 1,000 crypto wallets linked to Russian security services

Editor's note: NewsCafe staff members too were targets of several attacks by scammers throughout 2023, losing control over a social media account, and getting their money stolen - thanksfully in small amounts. You can buy them a coffee via PayPal: office[at]rudeana.com.