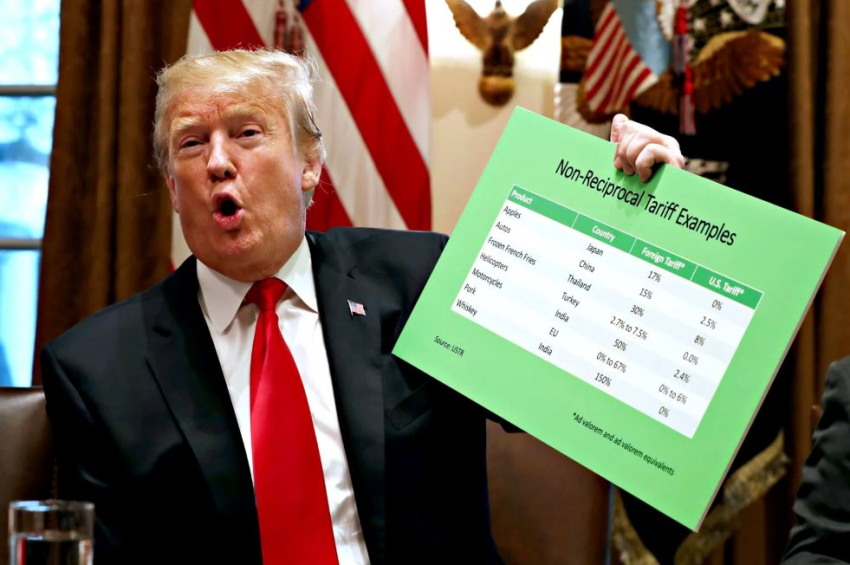

Think tank predicts new Trump tariffs will generate $500-billion annual blows to US economy

The Peterson Institute for International Economics has warned in a new policy brief that the eventual victory of the Republican candidate in the United States presidential election this year could be disastrous for American economy.

If Donald Trump keeps his promise to introduce a new 10% tariff on all U.S. imports and a 60% tax on goods from China in 2025, the measure will generate a $500 billion burden for the U.S. market yearly.

The lower-income and poorest Americans will suffer most while the rich citizens will be advantaged, the Peterson economists warn.

“This calculation implies that the costs from Trump’s proposed new tariffs will be nearly five times those caused by the Trump tariff shocks through late 2019, generating additional costs to consumers from this channel alone of about $500 billion per year,” the analysis reads.

On average, a middle-income household would pay $1,700 more a year but the poorest 50% of households, who tend to spend a bigger proportion of their earnings, will see their disposable income slashed by 3.5%.

Explaining how the new tariff/tax policies will harm the working class, the Washington-based think-tank’s research suggests that the tax cuts and tariff increase are sharply regressive policy changes that shift tax burdens away from the rich towards the poor members of society.

More to read:

China still dominates supply of critical minerals to U.S.

The analysis authors note that the cost of such policies would constitute 1.8% of U.S. GDP and does not take into account further damage from America’s trading partners retaliating and other side effects such as loss of competitiveness.

The tariffs Trump imposed in 2018 generated a trade war with China and shocked allies, and they are still hurting American companies and consumers.

***

NewsCafe is an independent outlet that cares about big issues. Our sources of income amount to ads and donations from readers. You can support us via PayPal: office[at]rudeana.com or paypal.me/newscafeeu. We promise to reward this gesture with more captivating and important topics.