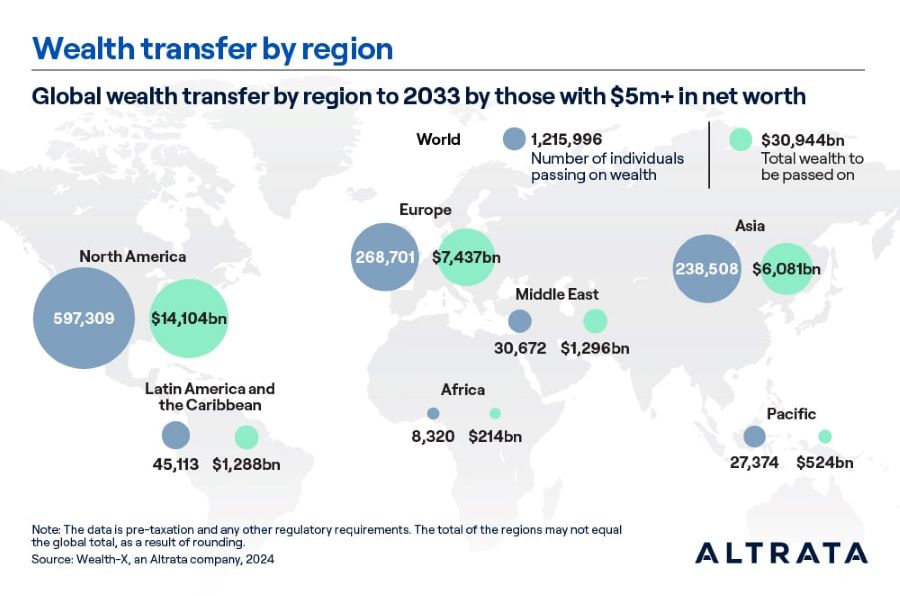

How much family wealth will be transferred during the next decade?

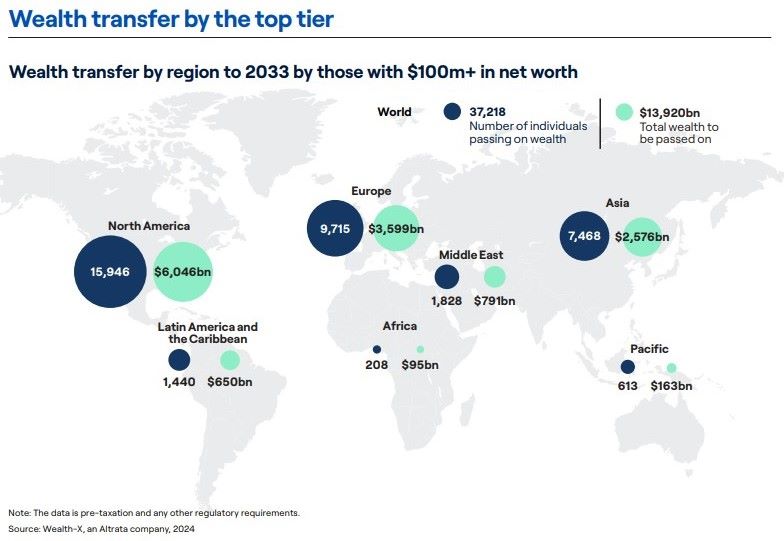

Over the next decade, more than a quarter of wealthy individuals are expected to transfer their fortunes while the values and methods of wealth transfer among these individuals and their families will have significant implications for various sectors, including family offices, financial services, the luxury goods industry, and non-profit organizations, a new report claims.

More to read:

Where are wealthiest people migrating in 2023?

Altrata’s latest global wealth transfer analysis delves into the growing focus on succession planning and the wealth transition process among the global population of wealthy individuals with a net worth exceeding $5 million, especially those with fortunes over $100 million.

More to read:

What are the sources of wealth of the world’s richest monarchs?

Family wealth transfers will be influenced by global trends and a complex geopolitical environment. Key trends include intricate succession planning for increasingly globalized wealthy families, highlighting the essential role of expert advisors. There is also a notable disparity between the values, experiences, and aspirations of wealth holders (often founders) and their younger benefactors. Additionally, there is a growing trend of wealth being passed on during the lifetime of the family head rather than solely upon death, necessitating early engagement and preparation.