Will Bitcoin market crash if U.S. sells Silk Road assets?

On 7 October, the Supreme Court declined to hear a case regarding the ownership of 69,370 Bitcoin seized from the Silk Road, a dark web marketplace, thus clearing the path for the U.S. government to sell the seized cryptocurrency valued at $4.38 billion.

The decision ends a legal challenge brought by Battle Born Investments, which had claimed rights to the Bitcoin, asserting it purchased those rights through a bankruptcy estate tied to Raymond Ngan, whom they alleged to be "Individual X," the person who stole the Bitcoin from Silk Road.

More to read:

The U.S. approves ETFs for Bitcoin investments. What does it mean?

A federal court in California ruled against Battle Born Investments, determining that Ngan was not "Individual X," a decision upheld by a federal appeals court in San Francisco.

With the Supreme Court's refusal to hear the case, the legal battle is over, and the government is expected to move forward with the sale.

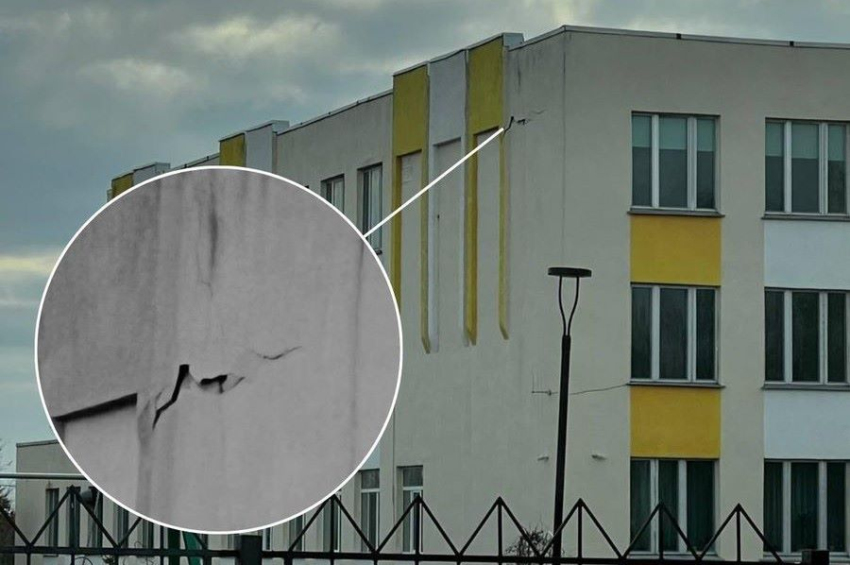

In preparation for this sale, the government has already transferred large amounts of Bitcoin to new wallets, a common step before liquidation. The assets are likely under the management of Coinbase Prime, given the US Marshals Service’s custody agreement with the platform. Back in August, financial lawyer Scott Johnsson predicted the sale after noticing 19,000 BTC moved into a Coinbase account.

The eventual sale of such a large cache of seized cryptocurrency could shake the Bitcoin market, which still remembers the volatility caused by Germany’s sale of nearly 50,000 Bitcoin seized from the illegal streaming site Movie2k.to.

Despite these concerns, the crypto news website Invezz quotes some crypto community members as saying that the market will be able to absorb the sale and the impact will be minor.

***

NewsCafe is an independent outlet that cares about big issues. Our sources of income amount to ads and donations from readers. You can support us via PayPal: office[at]rudeana.com or paypal.me/newscafeeu. We promise to reward this gesture with more captivating and important topics.

![[video] Aerospace startup proposes sled launch system to push planes into space](/news_img/2024/11/15/news0_mediu.jpg)